Singapore’s dynamic property landscape is continually evolving, and few areas embody this transformation as distinctly as Lentor. Poised to become a vibrant, green residential enclave, the Lentor Hills Estate is drawing significant attention from both discerning homeowners and strategic investors. Within this burgeoning precinct, Lentoria emerges as a compelling new launch condominium, offering a unique blend of modern living, strategic location, and thoughtful design. Developed by TID, a reputable joint venture between Singapore’s prominent Hong Leong Holdings and Japan’s Mitsui Fudosan, Lentoria represents a commitment to quality and thoughtful urban planning.

Launched for preview on 17 February 2024, with its official sales commencement on 2 March 2024, Lentoria introduces 267 residential units to the market. This analysis delves deep into Lentoria’s value proposition, examining its pricing in the context of District 26, the strategic advantages of its location, the thoughtful design evident in its site and unit plans, and its long-term potential for both families and investors. We aim to provide a comprehensive, objective perspective, empowering you with the insights needed to make an informed decision in Singapore’s competitive new launch market.

Lentoria is not merely another residential development; it is a meticulously planned condominium designed to integrate seamlessly into the evolving Lentor Hills Estate. With 267 units, it stands as one of the more exclusive projects within the precinct, offering a sense of privacy and community often sought after in today’s urban living. This section provides a foundational understanding of Lentoria’s key attributes, from its developer credentials to its initial market performance.

The development is a brainchild of Lentor View Pte Ltd, a joint venture that leverages the extensive experience of Hong Leong Holdings and the international expertise of Mitsui Fudosan. Hong Leong Group, a leading property developer in Singapore, boasts a long-standing track record of delivering quality residential and commercial projects. Established in 1968, Hong Leong Holdings has been involved in nearly 100 residential developments and manages numerous commercial properties across Singapore, including iconic projects like The Avenir and Tate Residences. Mitsui Fudosan, a major Japanese real estate conglomerate with a history dating back to 1941, is globally renowned for its meticulous design, high standards in urban development, and expansive portfolio that includes hotels, resorts, retail facilities, and office buildings, with notable international projects such as Tokyo Midtown in Japan and St Regis Hotel & Residences in Singapore. This long-standing partnership, established in 1972, brings together a unique blend of local market understanding and international design precision, instilling confidence and assuring prospective buyers of a well-conceived and expertly executed project.

Lentoria, a 99-year leasehold condominium from 19 September 2022, launched its preview on 17 February 2024, with sales commencing on 2 March 2024. During its launch weekend, 50 units were sold, representing approximately 19% of the total project. This initial absorption, while moderate compared to some earlier Lentor blockbusters, demonstrated a discerning yet receptive market. By January 2025, the take-up rate had steadily climbed to 67.8%, with 181 units sold at an average price of S$2,183 psf. As of mid-June 2025, the project has achieved a commendable 78% sales rate. This sustained absorption reflects persistent buyer interest in the Lentor area’s transformation and Lentoria’s unique value proposition.

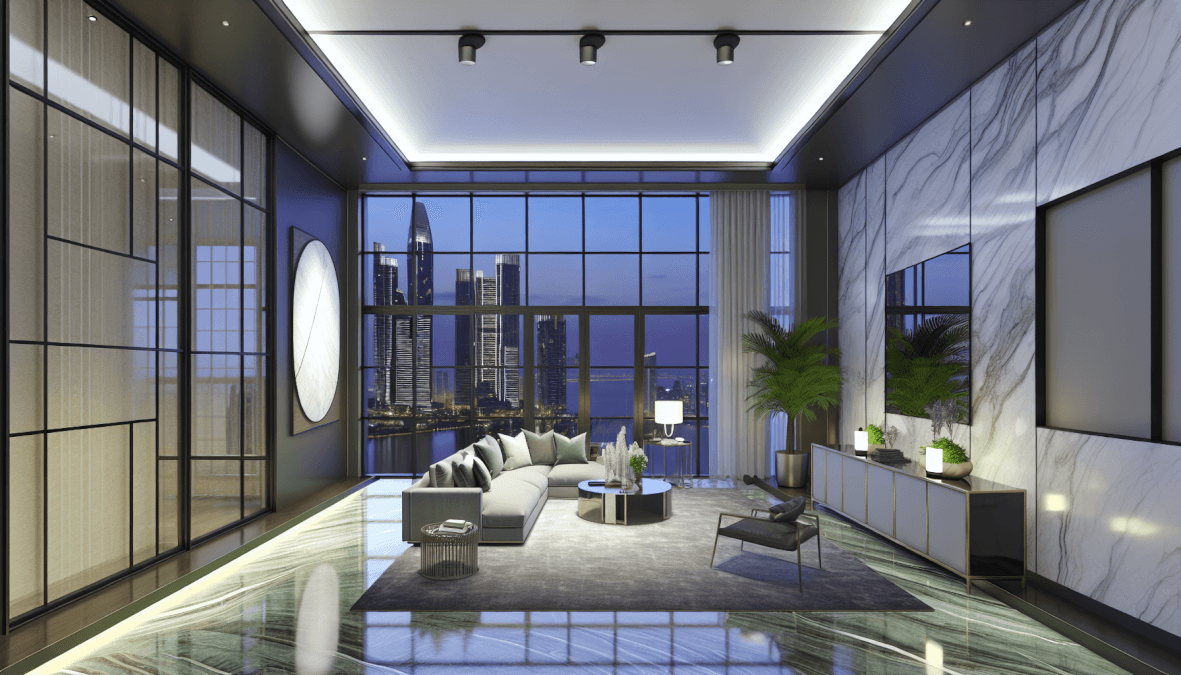

Lentoria is expected to achieve its Temporary Occupation Permit (TOP) by July 2027 and its Legal Completion by July 2030. Indicative launch prices for Lentoria began from S$1,965 psf, with an overall average launch price of S$2,120 psf. Specifically, a 1-Bedroom unit (538 sqft) was priced from S$1.18 million (approximately S$2,190 psf), while 2-Bedroom units (700-732 sqft) started from S$1.4 million (approximately S$1,965 psf). Larger 3-Bedroom units (915-1,119 sqft) were available from S$1.8 million (approximately S$1,974 psf). Current price ranges for available units are approximately S$1.2 million to S$3.41 million, translating to S$1,836 to S$2,733 psf, reflecting market adjustments and unit-specific premiums. These figures demonstrate a competitive positioning within the new Lentor market, aligning with the quality and comprehensive features Lentoria offers. The design philosophy, spearheaded by DP Architects for its contemporary structures and DP Green for its lush landscape, aims to create a tranquil, resort-like environment that integrates seamlessly with its natural surroundings. The commitment to sustainability enhances both livability and long-term value.

The strategic location of a new launch condominium is often paramount to its long-term value, and Lentoria is no exception. Situated within the Lentor Hills Estate, it benefits directly from the Urban Redevelopment Authority’s (URA) visionary Master Plan, which seeks to transform this area into a thriving, well-connected, and green residential hub. Understanding the surrounding locale is crucial for both owner-occupiers seeking a fulfilling lifestyle and investors eyeing future growth potential.

Lentoria’s most significant locational advantage is its exceptional connectivity. It is positioned to benefit directly from the Lentor MRT Station (TE5), a key node on the Thomson-East Coast Line (TEL). This provides residents with direct, seamless access to Singapore’s core regions. For instance, commuting to Orchard Road, Singapore’s premier shopping district, can take approximately 20-25 minutes by MRT, while the Central Business District (CBD) and Marina Bay area are within a convenient 30-35 minute ride. This direct line significantly reduces travel times and enhances daily convenience for professionals working in the city centre. Beyond the MRT, Lentoria’s location at the corner of Lentor Gardens and Yio Chu Kang Road offers excellent road connectivity, providing swift access to major expressways such as the Central Expressway (CTE), Seletar Expressway (SLE), and Tampines Expressway (TPE), facilitating island-wide travel for those who drive. The future North-South Corridor (NSC), anticipated to be operational from 2026, will further enhance driving connectivity, significantly reducing travel times to the city for residents in the northern region.

For families with school-going children, Lentoria holds a compelling advantage: its highly coveted proximity to CHIJ St. Nicholas Girls’ School. This popular primary school falls within the crucial 1km radius of Lentoria, making it a significant draw for parents prioritising quality education and convenient school runs. Also within the 1km radius is Anderson Primary School. This desirable school proximity provides a durable niche appeal for Lentoria, ensuring consistent demand from a specific segment of the buyer market. Beyond primary education, the broader Lentor Master Plan includes provisions for childcare centres, with one already integrated into the Lentor Modern development, offering essential support for younger families. The surrounding mature estates of Ang Mo Kio, Yishun, and Bishan also provide a wealth of established educational institutions, ranging from secondary schools like Presbyterian High School and Yio Chu Kang Secondary School to junior colleges (Eunoia Junior College, Anderson Serangoon Junior College) and tertiary institutions (Nanyang Polytechnic), enhancing the area’s appeal for long-term family living.

The ‘Lentor Transformation’ isn’t just about homes; it’s about creating a holistic lifestyle ecosystem. A cornerstone of this transformation is the integrated retail mall at Lentor Modern, which spans an impressive 96,000 sq ft. This mall is designed to serve the entire Lentor Hills Estate, featuring a supermarket (CS Fresh) for daily essentials, a childcare centre (ChildFirst Pre-school), and a diverse range of food and beverage outlets, alongside various retail options. This means residents of Lentoria will have immediate access to a comprehensive suite of amenities right at their doorstep, fulfilling daily needs without the need to travel far. This convenience greatly enhances the quality of life for owner-occupiers and adds significant appeal for potential tenants, given the demand for live-work-play environments. Furthermore, the established amenities in nearby mature estates like Ang Mo Kio, Yishun, and Bishan provide even broader retail, dining, and recreational choices, including larger shopping malls like AMK Hub, Northpoint City, and Junction 8, ensuring that residents have access to everything they might need within a short drive or MRT ride.

The URA Master Plan for Lentor places a strong emphasis on green living, aiming to create a tranquil and sustainable environment. Lentoria residents will benefit from this vision, with plans for new parks, such as the upcoming Hillock Park, and an extensive network of pedestrian and cycling pathways. These green spaces offer ample opportunities for outdoor recreation, leisurely strolls, and fostering a healthier lifestyle. The master plan also includes the development of new community facilities, designed to foster a vibrant and interactive neighbourhood atmosphere. For owner-occupiers, this translates to an enhanced living environment with abundant recreational options and a strong sense of community. For investors, a green and well-planned neighbourhood typically retains its value better and attracts a stable tenant base who appreciate such amenities. The commitment to these enhancements reinforces the area’s long-term appeal and justifies the premium associated with being part of this transformative precinct. Lentoria’s own landscaping design extends to external green spaces carved out along its perimeter, creating micro parks and gardens accessible to the public, further integrating the development into the broader green vision for Lentor Hills Estate.

The success of a residential development extends beyond its location; it hinges significantly on the intelligent design of its site plan and the thoughtful integration of its facilities. Lentoria’s site configuration, amenity provisions, and overall design philosophy have been carefully considered to maximise livability and enhance the resident experience, setting it apart within the competitive Lentor Hills Estate.

Lentoria occupies the Lentor Hills Road Parcel B, strategically positioned at the corner of Lentor Gardens and Yio Chu Kang Road. This specific corner plot offers a unique advantage: many units within the development benefit from unobstructed views of the surrounding landed estates, particularly the Teachers’ Housing Estate, and nearby nature parks like Thomson Nature Park and Peirce Reservoir Park. This is a significant premium, particularly in land-scarce Singapore, where unblocked views are highly sought after and can command higher values. The design likely incorporates optimal north-south orientation for many blocks, a common architectural practice in Singapore to maximise natural ventilation and minimise direct afternoon sun exposure, contributing to cooler interiors and reduced energy consumption. The development features three blocks, with two rising to 17 storeys and one to 8 storeys, thoughtfully designed to capture these optimal orientations and views.

Lentoria is designed to be a self-contained oasis, offering a comprehensive suite of modern communal facilities that cater to diverse recreational and lifestyle needs. This includes multiple swimming pools, such as a 50-metre lap pool and a kid’s wading pool, alongside hydrotherapy pools, state-of-the-art gymnasiums, and stylish clubhouses designed for relaxation and social gatherings. Unique features like a maze garden, forest and water pavilions, and a fernery contribute to a distinctive resort-like atmosphere. The landscape design, meticulously crafted by DP Green, integrates themed gardens and lush greenery across over 50% of the site, creating a tranquil environment that encourages residents to unwind and connect with nature. The architectural design by DP Architects contributes to a contemporary aesthetic, ensuring that the visual appeal of the development is as strong as its functional offerings. For owner-occupiers, these extensive facilities translate into an enriched daily life, with convenience and leisure just steps from their door. For investors, such comprehensive and modern facilities enhance the attractiveness of the property to potential tenants, potentially commanding higher rental rates and reducing vacancy periods.

One of Lentoria’s defining characteristics is its relative exclusivity. With just 267 units, it is one of the smallest developments in the Lentor Hills Estate. This contrasts sharply with its neighbours like Lentor Modern (605 units), Lentor Hills Residences (598 units), Hillock Green (474 units), and Lentor Mansion (533 units). This smaller scale translates into a less crowded living environment, fostering a more private and intimate community feel. For owner-occupiers, this means less congestion at communal facilities and a potentially more peaceful living experience. For investors, while larger projects might offer more unit choices, a smaller, more exclusive development like Lentoria can sometimes appeal to a niche segment of tenants willing to pay a premium for a quieter and more private residence. This differentiation can be crucial in a future market where numerous new units will be completed concurrently in the Lentor precinct, allowing Lentoria to carve out a distinct identity based on its lower density.

Lentoria offers a thoughtfully curated selection of unit types designed to cater to a broad spectrum of buyers, from young professionals and couples to growing families and multi-generational households. Understanding the unit mix, their respective pricing, and the target demographics for each type is essential for both aspiring homeowners and shrewd investors looking to capitalise on the Lentor transformation.

This table outlines the comprehensive unit distribution at Lentoria, providing a clear overview of the available home types and their respective sizes.

| Unit Type | Number of Units | Size Range (sqft) | Size Range (sqm) |

|---|---|---|---|

| 1-Bedroom | 23 | 538 | 50 |

| 2-Bedroom | 92 | 700 – 732 | 65 – 68 |

| 2-Bedroom + Study | 28 | 732 | 68 |

| 3-Bedroom | 48 | 915 – 958 | 85 – 89 |

| 3-Bedroom Premium | 22 | 1,119 | 104 |

| 4-Bedroom | 38 | 1,206 | 112 |

| 4-Bedroom Premium | 16 | 1,345 | 125 |

During its launch phase, Lentoria presented competitive pricing, reflecting the overall market sentiment and the development’s unique value propositions. The indicative price ranges by unit type were reported as:

These prices, while representing a premium over older resale properties in District 26, are consistent with other new launches in the Lentor area, validating the market’s acceptance of the ‘new normal’ pricing for this transforming precinct. The overall price range for units currently available stands at S$1,836 to S$2,733 psf, reflecting the varying premiums for different unit types, stack locations, and views.

The diverse unit types offered at Lentoria naturally appeal to distinct buyer profiles, each with their own unique motivations:

Understanding these target audiences allows you to evaluate which unit type best aligns with your personal needs and investment objectives, ensuring a strategic purchase within Lentoria.

The true essence of a home is often discovered within its living spaces. Lentoria’s unit designs are a testament to modern architectural principles, blending functionality with contemporary aesthetics to create highly livable environments. This section delves into the thoughtful layouts, premium finishes, and integrated features that define the residential experience at Lentoria, offering insights for both prospective residents and discerning investors.

Lentoria’s units are meticulously designed for modern lifestyles, with layouts that prioritise efficiency and maximise usable space. Unlike some older condominiums, new launches like Lentoria focus on minimising wasted areas, ensuring every square foot serves a purpose. This efficiency is crucial in Singapore’s high-density urban environment. A key advantage of Lentoria’s construction method is that it does not utilise the Prefabricated Pre-finished Volumetric Construction (PPVC) method. This non-PPVC approach provides homeowners with greater flexibility to modify internal layouts and hack walls, allowing for a higher degree of customisation to suit individual preferences and evolving needs. For instance, the inclusion of dedicated study nooks or flexible spaces in many units is a direct response to the growing trend of remote working and the need for adaptable living environments. These thoughtful additions allow residents to adapt their homes, whether it’s for a home office, a children’s study area, or a quiet reading corner. The emphasis on open-concept living in common areas promotes a sense of spaciousness and encourages family interaction, while bedrooms are designed to be comfortable and private sanctuaries, ensuring optimal functionality for various household compositions.

One of the significant advantages of purchasing a new launch property like Lentoria is the assurance of brand-new, high-quality fittings and appliances. Each unit comes equipped with contemporary fixtures and finishes, removing the immediate need for costly renovations that are often necessary when purchasing older resale properties. This ‘move-in ready’ condition offers substantial convenience and cost savings for owner-occupiers. Furthermore, Lentoria incorporates smart home provisions, allowing residents to control lighting, air conditioning, and other features through smart devices. This technological integration enhances comfort, convenience, and energy efficiency, aligning with the expectations of today’s tech-savvy homebuyers. The selection of materials, from flooring to kitchen countertops and bathroom fittings, reflects a commitment to durability and aesthetic appeal, contributing to a premium living experience. For investors, these modern amenities and the absence of renovation requirements make the units highly appealing to prospective tenants, potentially leading to quicker occupancy and better rental returns.

Beyond aesthetics, the architectural design of Lentoria (by DP Architects) and its site orientation are planned to maximise natural light and cross-ventilation throughout the units. The careful positioning of windows and balconies, especially in units with unblocked views of the surrounding landed estates and nature parks, ensures ample daylight penetration, reducing the reliance on artificial lighting during the day. This natural illumination creates bright and airy living spaces, contributing to a sense of well-being. Coupled with effective cross-ventilation, which allows air to flow through the units, residents can enjoy a cooler and more comfortable indoor environment, leading to potential energy savings on air conditioning. The incorporation of vertical fins on the façade also acts as a passive design element, strategically positioned to provide sun shade while maximising natural light. This emphasis on passive design elements contributes significantly to the overall livability and sustainability of the homes.

Evaluating a new property launch goes beyond immediate gratification; it involves assessing its enduring value for both personal living and investment growth. Lentoria presents a nuanced proposition, balancing its initial price premium with the transformative potential of the Lentor Hills Estate. This section dissects the financial and lifestyle aspects that contribute to Lentoria’s long-term appeal for both owner-occupiers and savvy investors.

This table offers a comparative analysis of Lentoria’s pricing against other new launches and older resale condominiums in the Lentor and District 26 area, highlighting the value proposition.

| Development | Tenure | Average PSF (Approx.) | Type |

|---|---|---|---|

| Lentoria | 99-year Leasehold (New) | S$2,120 (Launch) | New Launch |

| Lentor Modern | 99-year Leasehold (New) | S$2,100 – S$2,121 | New Launch |

| Lentor Hills Residences | 99-year Leasehold (New) | S$2,080 – S$2,099 | New Launch |

| Hillock Green | 99-year Leasehold (New) | S$2,108 | New Launch |

| The Panorama | 99-year Leasehold (Older) | S$1,848 | Resale |

| The Calrose | Freehold (Older) | S$1,790 | Resale |

| Bullion Park | Freehold (Older) | S$1,596 | Resale |

Lentoria’s average launch price of S$2,120 psf positions it firmly at a premium compared to older, freehold condominiums in District 26. For context, older developments like The Calrose (completed 2007) currently transact at an average of approximately S$1,790 psf, while Bullion Park (completed 1992) averages around S$1,596 psf. This translates to a significant premium of approximately 18-22% over The Calrose and 33-37% over Bullion Park. This premium is multi-faceted and justifiable. Firstly, it reflects the higher land acquisition cost of S$1,130 psf ppr for Lentoria’s Government Land Sales (GLS) site, which was among the highest for non-integrated Lentor parcels at the time. Secondly, it accounts for rising construction costs, financing, and marketing expenses, pushing the estimated breakeven cost to around S$1,730 to S$1,830 psf. Lastly, and crucially, this premium encapsulates the value of a brand-new development with modern facilities, its direct proximity to the new Lentor MRT station, and the broader ‘Lentor Transformation’ which promises enhanced amenities and infrastructure, a value older properties simply cannot offer.

The primary buyer demographic for Lentor projects, including Lentoria, consists overwhelmingly of Singaporeans, with owner-occupiers, particularly HDB upgraders from neighbouring mature estates like Ang Mo Kio, Yishun, and Bishan, forming a significant segment. The allure of the 1km radius to CHIJ St. Nicholas Girls’ School and Anderson Primary School also specifically targets young families. Investors are equally drawn by the area’s ongoing transformation and the potential for robust rental demand due to improved connectivity. From an affordability standpoint, considering a 3-bedroom unit priced at S$2.112 million, a household would require an estimated minimum gross monthly income of S$11,500 to S$12,000 to meet the 55% Total Debt Servicing Ratio (TDSR) framework, assuming a 25% downpayment and no other debt obligations. This income bracket aligns with upper-middle-income households, typical of successful HDB upgraders with accumulated savings. Lentoria’s initial sales of 19% on launch weekend, while moderate compared to earlier Lentor blockbusters like Lentor Modern (84%), are consistent with Lentor Hills Residences (50%) and Hillock Green (27.8%), indicating a market that is discerning but still highly receptive to the Lentor proposition. Steady sales since launch, reaching 78% by mid-June 2025, demonstrate sustained interest, with buyers weighing the unique attributes of each project.

For investors, understanding potential rental yields is paramount. Existing older, freehold condominiums in District 26, such as The Calrose and Bullion Park, show implied rental yields of approximately 2.4% and 2.6% respectively. New launches like Lentoria, while commanding higher purchase prices, are expected to achieve better rents due to their modern facilities, newness, direct MRT access, and sustainable features. For a 2-bedroom unit in Lentoria costing approximately S$1.689 million, a projected monthly rent of S$4,000 – S$4,500 could yield a gross rental return of approximately 2.8% to 3.2%. The tenant pool will likely include professionals and expatriates working along the TEL corridor and families drawn by nearby schools. However, it is a consideration that the substantial future supply of over 3,000 new units in the Lentor estate over the next 3-7 years could create a competitive rental environment upon project completion, potentially moderating initial rental yield growth. Therefore, investors should adopt a long-term perspective, focusing on the estate’s maturation and their unit’s unique differentiators such as unblocked views or school proximity.

Capital appreciation for Lentoria is intrinsically linked to the success of the broader ‘Lentor Transformation.’ Historically, new launches within government-led precinct transformations in the Outside Central Region (OCR) have demonstrated healthy capital appreciation. Lentor Modern, as the first integrated development in the area, has seen its average transaction price hold firm around S$2,100 psf since its 2022 launch. District 26 as a whole experienced a remarkable 21% year-on-year price growth in the past year, predominantly driven by the new Lentor launches, pushing its overall average price to S$2,107 psf. This strong performance positions District 26 as a leader in district-level price growth. The long-term appreciation potential for Lentoria will hinge on the successful realisation of the URA’s vision for Lentor as a green, well-connected residential enclave. Factors such as its exclusivity, 1km proximity to CHIJ St. Nicholas Girls’ School and Anderson Primary School, its unique orientation offering unblocked views, and its non-PPVC construction will be crucial differentiators in a competitive future resale market, helping to sustain its value against future supply and enhance its appeal to a broad range of buyers and tenants.

Beyond investment figures, Lentoria offers compelling value for families. The indisputable draw of being within 1km of CHIJ St. Nicholas Girls’ School and Anderson Primary School is a significant advantage for parents, simplifying school commutes and enhancing daily convenience. The URA Master Plan’s emphasis on new parks, such as Hillock Park, and extensive pedestrian and cycling pathways provides ample green spaces for children to play and families to bond outdoors. The integrated retail mall at Lentor Modern ensures that daily necessities, F&B options, and childcare facilities are readily accessible, creating a self-sufficient and family-friendly neighbourhood. For owner-occupiers, this translates to a modern, convenient, and nurturing environment, designed to support a high quality of family life. These attributes not only enhance daily living but also contribute to the property’s long-term desirability, ensuring a stable tenant pool for investors and a robust resale market for owner-occupiers, underpinned by strong demand from families prioritising education and lifestyle amenities.

Lentoria emerges as a significant new launch in District 26, anchoring a new pricing benchmark within the rapidly transforming Lentor Hills Estate. Its average launch prices, exceeding S$2,100 psf, clearly reflect the premium associated with a brand-new development, modern facilities, direct MRT connectivity, and the extensive government-led ‘Lentor Transformation’. This premium is also a direct consequence of high land acquisition and construction costs faced by developers today. While the market has demonstrated strong underlying demand, as evidenced by Lentoria’s steady take-up rate, which reached 78% by mid-June 2025, prospective buyers must critically evaluate their objectives amidst the significant pipeline of future residential supply in the immediate vicinity.

For owner-occupiers, Lentoria’s value proposition is compelling. The proximity to Lentor MRT Station offers unparalleled connectivity, drastically cutting commute times to key business and lifestyle hubs. The coveted 1km radius to CHIJ St. Nicholas Girls’ School and Anderson Primary School provides a powerful draw for young families, simplifying schooling decisions and daily routines. Furthermore, the exclusive scale of 267 units promises a more private and serene living environment compared to larger developments, while the thoughtfully designed facilities and modern unit layouts offer a superior quality of life that older properties cannot match. The non-PPVC construction method provides an added benefit of layout flexibility, allowing for personal customisation. Your decision should largely revolve around whether this holistic lifestyle, underpinned by strategic convenience, a planned green environment, and the ability to tailor your living space, aligns perfectly with your family’s long-term aspirations. While you will experience a period of ongoing development in the estate, the promise of a fully realised, integrated community is a substantial payoff.

For investors, Lentoria represents a long-term strategic bet on the maturation of the Lentor precinct. While initial rental yields might face some pressure upon the concurrent completion of multiple projects in the area—creating a temporary supply glut—the capital appreciation potential remains robust, driven by the successful realisation of the URA’s Master Plan for Lentor. The area’s transformation into a vibrant, well-connected hub with integrated amenities is a strong narrative for sustained value growth. Focusing on units with strong differentiators, such as those with unobstructed views, optimal layouts, or proven appeal to specific tenant segments (e.g., families seeking school proximity), will be key to protecting and enhancing your investment in a competitive market. Investors should be financially prepared to weather any short-to-medium-term market fluctuations and maintain a long-term outlook to fully capitalise on the estate’s growth. In essence, purchasing a new launch in Lentor is an investment in a government-backed vision of a modern, integrated, and green residential enclave. The price reflects this future promise, and buyers must weigh that premium against the tangible risks of concentrated supply and their own financial capacity and long-term housing objectives.

Don’t miss your chance to be part of this exceptional development—get in touch with our team of experts to explore your options today.

This table provides a concise overview of Lentoria’s key project details, offering essential information at a glance.

| Feature | Detail |

|---|---|

| Developer | Lentor View Pte Ltd (TID Residential Pte Ltd) |

| Joint Venture | Hong Leong Group & Mitsui Fudosan |

| Tenure | 99-year Leasehold from 19 September 2022 |

| Expected TOP | July 2027 |

| Expected Legal Completion | July 2030 |

| Total Units | 267 |

| Site Area | 116,456 sqft (10,819 sqm) |

| Number of Blocks | 3 (2 x 17 storeys, 1 x 8 storeys) |

| Architect | DP Architects Pte. Ltd. |

| Landscape Consultant | DP Green Pte. Ltd. |

| Main Contractor | Lian Beng Construction (1988) Pte. Ltd. |

Get exclusive updates and early access to upcoming property launches